Borrowing shouldn't feel complicated or risky. With Creditspring, you know exactly what you'll pay and when.

Check your eligibility

A quick, simple check to see if you can join.

Unlock your loans

Get your first loan after your 14-day cooling-off period, then another once it's repaid.

Build as you go

Build your credit score with every on-time payment. Remember, other factors can affect your score.

Whether you're building credit or getting back on track, we have a plan that works for you.

Get the credit support you need to stay in control and build confidence with every step.

Just one simple membership fee plus your loan repayment. If life gets messy, we'll help you stay on track.

Every on-time repayment counts and is reported to UK credit agencies. Remember, other factors can affect your score.

Renew your membership with ease for simple, stress-free access to funds and renewed peace of mind.

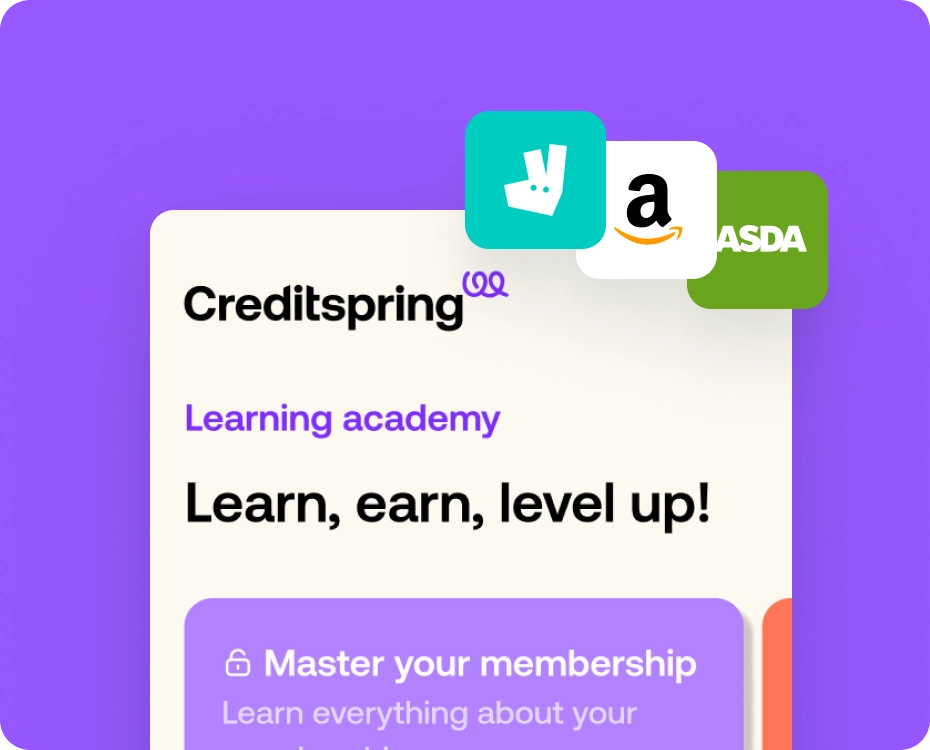

Explore expert tips, learning resources, and financial tools that make money management simpler.

See what’s helping (and hurting) your score, and what to do next.

We’ll help you uncover support you might not even know you’re entitled to in unclaimed benefits, grants and discounts.

Bite-sized lessons that make financial know-how easy and empowering. Earn gift cards while you learn.

Members love how clear, caring, and reliable our service feels — especially when life gets unpredictable.

We know financial products can be difficult to get to grips with, so we've included some of the key questions you may have. However, if the question you need an answer to isn't here, head over to our Help Centre for more.

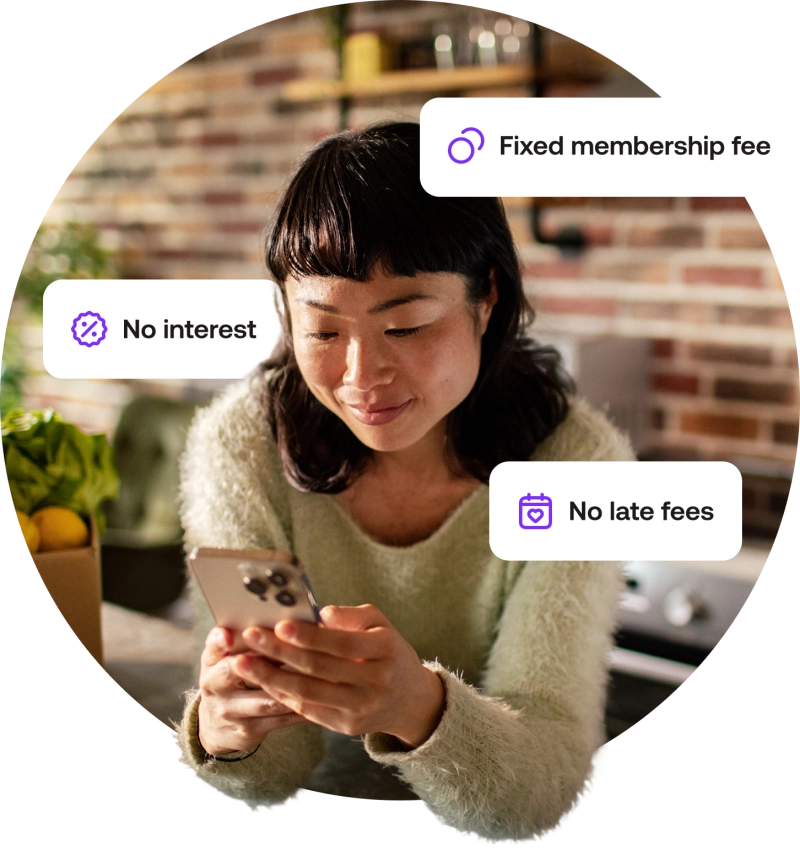

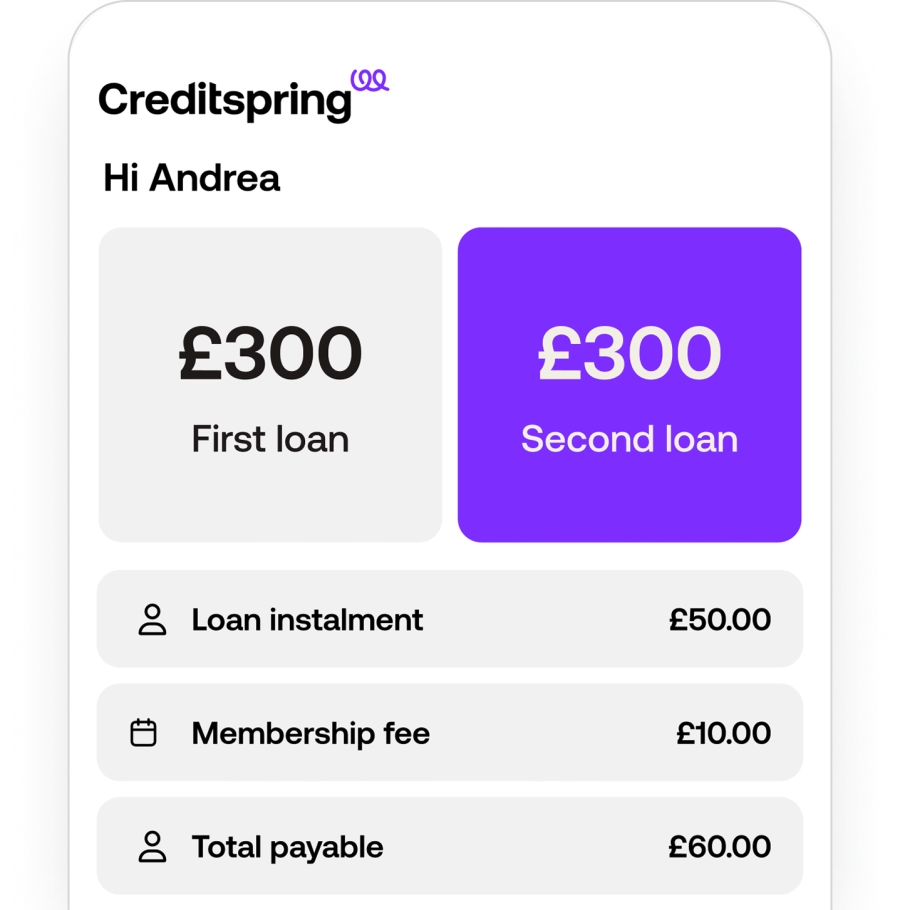

We offer various memberships that will assist you in planning for your future, building your financial stability and boost your finances for unexpected expenses. There is a limit of one membership per person, and there are 12 monthly instalments.

We do things a bit differently. Instead of adding interest, we'd rather give you a no-interest loan and charge a membership fee that is spread over the course of your agreement. We believe this is a simpler and honest way of doing business. It also means that as a member, you know you'll never pay more than your monthly membership fee and what you borrowed. Read on here

There are many factors involved in determining if you are eligible for a Creditspring membership. The following are some of the requirements to apply for a Creditspring membership:

Creditspring membership is subject to status. Terms and conditions apply.

If you're a Core member, and you borrow both advances as early as allowed under the agreement (for example, after your 14-day cooling-off period) and you repay each instalment in full and on time, the APR is 83.1%.

However, if you choose to borrow only one advance, and you do so at the earliest point permitted, repay each instalment in full and on time, and the agreement runs for a minimum term of 12 months, the APR would be 162.5%

It is important to note that we don't offer refunds on monthly fees if you decide not to borrow the maximum amount of credit available to you during your membership. As always, it is important to read all the terms of your agreement before taking up a product with us. Read on here

If you apply for a Creditspring membership and are not eligible, it will not affect your credit score. It will leave a “soft footprint” on your credit report that only you will be able to see.

If you are eligible for a Creditspring membership and you accept a membership, our credit check will then be posted as a “hard footprint” on your credit report, accessible by other lenders. Once you are a member, we will continue to report your monthly membership payments and any repayments of your advances to the credit agencies.

Yes, Creditspring is a direct lender. We provide small, personal loans – sometimes referred to as direct lender loans – that are disbursed directly to you. This means there's no broker or middleman, you just deal with us. We'll approve (or reject) your application, and we'll transfer the funds to your bank account, if your application is successful.