Whether you’re kicking off your credit journey or getting back on track, Go is designed to improve your eligibility for our loans - all for only £7 a month.

Maintain a consistent payment streak, and we will start checking your eligibility from month 3. If you still don't qualify for a loan at the end of term, we'll refund you in full. T&Cs apply

If you've just moved to the UK, don't have a credit history yet, and want to work towards being able to access a loan.

If you have a limited credit history, haven't needed credit before, and want to improve your eligibility for a loan.

If you've had high levels of debt in the past or have been turned away for loans before, and want to improve your chances of becoming eligible again.

We'll ask you some simple questions so we can understand what Creditspring product is best for you.

We will check your eligibility for Go but also our loan products. If you're already eligible for a Creditspring loan, Go may not be our best product for you.

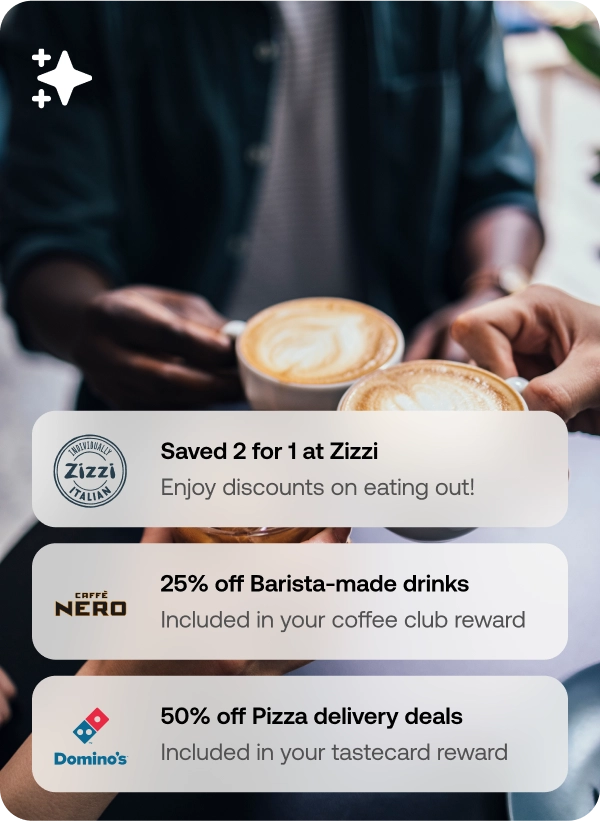

Explore our Go member benefits, including access to exclusive offers and tools to boost your financial health.

We know financial products can be difficult to get to grips with, so we've included some of the key questions you may have. However, if the question you need an answer to isn't here, head over to our Help Centre for more.

Creditspring Go is your first step towards improving your eligibility for a Creditspring loan. By making consecutive payments on time, your access to a Creditspring loan could be easier.

We will not report your payments to the credit agencies. This means your payments or missed payment won't affect your credit score. Our goal through Creditspring Go is to support you to gain access to our 2 x £200 loans per year.

This can vary, but after completing your payment streak (with no missed payments), we'll check if you can apply for our 2 x £200 loans per year. We'll start checking your eligibility from payment 3 so you can qualify sooner. If successful, you'll then be able to apply for a loan.

If you're not able to apply for our loan just yet, we'll continue to check for another two months (known as our eligibility screening period).

Pay a fixed membership fee, payable in twelve monthly payments of £7 , and start building your credit score with every on-time payment. Remember, other factors can affect your score. The 2 x £200 no-interest loans per year is included in our Step membership.

Representative example: Total amount of credit £400 repayable over 13 months (borrow £200 twice a year). Membership fee (total cost of credit) £84, payable in 12 monthly payments of £7. Interest rate 0% p.a (fixed). Representative 88.8% APR. The first repayment for each advance is £33.35, due approximately 6 weeks after drawing, followed by 5 monthly repayments of £33.33. Total amount payable £484.

We understand that circumstances may change, so if you're thinking of cancelling your Go membership, log into your account page and follow the steps. If you cancel before your membership ends, as per our terms and conditions, you will not receive a refund. In future if you would like to re-apply to Creditspring Go, you can do so three months after you cancel your membership.

Cancelling your Creditspring Go membership will not cancel your Creditspring Free membership. To find out more, please visit this article in our Help Centre.