Late and missed payments, along with other external factors, can have a negative effect on your credit score.

Late and missed payments, along with other external factors, can have a negative effect on your credit score.

Sometimes, managing your monthly cash flow can be tricky, especially when it comes to that bigger-than-usual bill or unexpected medical expense. These unpredictable outgoings can quickly push you over your budget, so you may need to borrow extra funds.

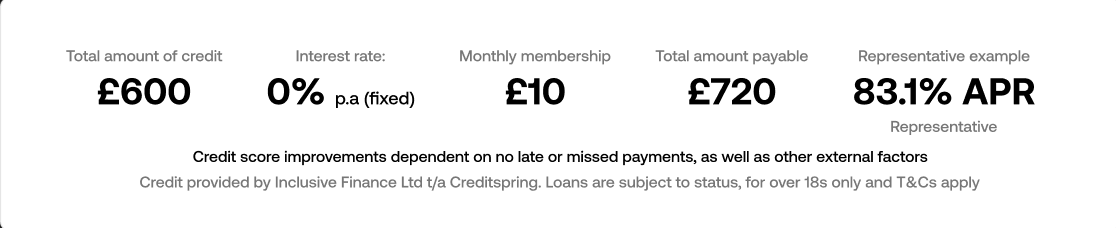

If a credit card is not a good option for you, here at Creditspring we can help with our no-interest £600 loan. It’s ideal for when you need a small loan and may be concerned about having bad credit, and you can even build your credit score in the process.

What’s more, to make things super-manageable, you’ll receive your no-interest loan in two equal instalments (£300 loan + £300 loan) across the year – all you pay on top is a small monthly membership fee. Simple!

Applying for a £600 loan from Creditspring is easy and takes only a few minutes. Use our free eligibility checker to get a response in less than a minute and see if you qualify.

If you are approved and choose to become a Creditspring member, we’ll let you know within a few minutes.

After your 14-day change-of-heart period, you can request the money to be paid into your bank account. Payments are made seven days a week, except for bank holidays.

At Creditspring, we take a different approach to most traditional lenders. While we too consider every enquiry carefully (even if you have a bad credit history and have been unsuccessful in finding a £600 loan with bad credit, for example), all our loans come with no interest.

Carefully created to help reduce the stress commonly associated with borrowing, our loans are delivered to our members in two equal instalments. In this instance, our £600 loan is split into two separate and manageable £300 loans – the first issued when you request it and the second available after you have paid the first off in full.

We believe this innovative design offers you more clarity and flexibility, so you can stay in control of your repayments. It’s a clear and transparent option if you don’t want the risk of feeling overwhelmed by a larger lump sum that may be more than you need

By regularly making the monthly repayments on your first £300 loan instalment on time and in full, you’ll not only have a manageable sum of money for your smaller, more immediate needs, you’ll also start improving your financial habits at the same time - and help boost that all-important credit score.

Once the first £300 loan is repaid, you can request the next £300 loan instalment – easy!

It’s certainly the approach we prefer to adopt! We believe that breaking down a larger loan into two smaller amounts sets us apart from many traditional lenders. If you’re looking for a £600 loan and you have bad credit, a loan from Creditspring can offer a more accessible and flexible borrowing option without the stress.

As we said earlier, managing a £300 loan instalment is generally less daunting than managing £600 in one go. A £300 loan can be comforting buffer for covering smaller, unexpected expenses, and can provide just the right amount of financial support without the complexities and burdens associated with larger loans.

Furthermore, if getting a £600 loan with bad credit is seriously limiting your borrowing options, two separate £300 loans rather than a single £600 lump sum will help you spread and stagger your repayments over time, so you can better manage your cash flow and reduce the pressure of having to make any immediate, large payments.

Ready to explore your borrowing options with us? As a £600 loan direct lender, our Creditspring two-part loan options are designed to help you when you need it most – and with ease.

In short, no. Not all lenders offer a £600 loan as some only offer large loans, while others offer small payday loans or cash advances. There are many lenders that offer £600 loans, including Creditspring, but it’s always recommended to look at the interest rates, APRs, and other loan terms.

To apply for a £600 loan from Creditspring you need to start by checking your eligibility. After you enter your details it will take less than 60 seconds to get a response. Best of all - checking your loan eligibility with Creditspring won’t affect your credit score.

To become a member of Creditspring and qualify for a £600 loan you:

Must be a UK resident

Must be at least 18 years old

Have a minimum income of £14,000 per year

Must not have any recent CCJs or been bankrupt

Use our free eligibility checker to see if you’ll be accepted

As with any loan application, when borrowing £600 you should comfortably afford the monthly payments. You should also have a good credit score and a regular income, be at least 18 years old and be a UK citizen to apply for a loan.

If you don’t have a good credit history, consider improving your credit score first, before you apply for a £600 loan online. Creditspring can help you improve your credit with Stability Hub.

Yes, you can still apply for a £600 loan even with a poor credit score. You may not get many loan offers to choose from, but there are lenders that are willing to offer loans to borrowers with bad credit. The offers you get will depend on factors like your credit score, income, and affordability.

If you want to apply for a £600 loan but have a bad credit score, Creditspring can help.

Sign up for the Stability Hub and start improving your credit score today. You’ll get the tools you need to keep track of your financial health and we’ll automatically notify you when you’re eligible for a loan.

When you become a Core member you will have access to two advances of £300, totalling £600. You have access to your first advance after your 14 day wait period and your second once the first has been paid in full. You’ll have low monthly payments and on-demand access to cash twice a year.

Unlike cash advances or payday loans, you don’t have to repay the loan within one month and you won’t even have to pay any interest rates! You simply repay the £600 loan over six or 12 months, along with your monthly membership fee. You may also repay your loan earlier by requesting a settlement amount.

Here’s why Creditspring could be a good option for your short-term loans:

Once approved, borrow the money you need when you need it

Enjoy no-interest loans with no hidden charges

Just pay a fixed membership fee

Eligibility checking only takes a minute

We can help you strengthen your credit rating

With all loans, whether they come in six-month instalments or bigger lump sums with longer payment terms, as a responsible lender we always ensure that you can comfortably afford the loan repayments. This will not only help your chance to qualify for great rates, but also build your credit score.

Your Creditspring membership will give you on-demand access to loans with no interest when you need it most. Read more about our Step (total loan amount £400), Core (total loan amount £600), Plus (total loan amount £1,000) and Extra (total loan amount £2,400).